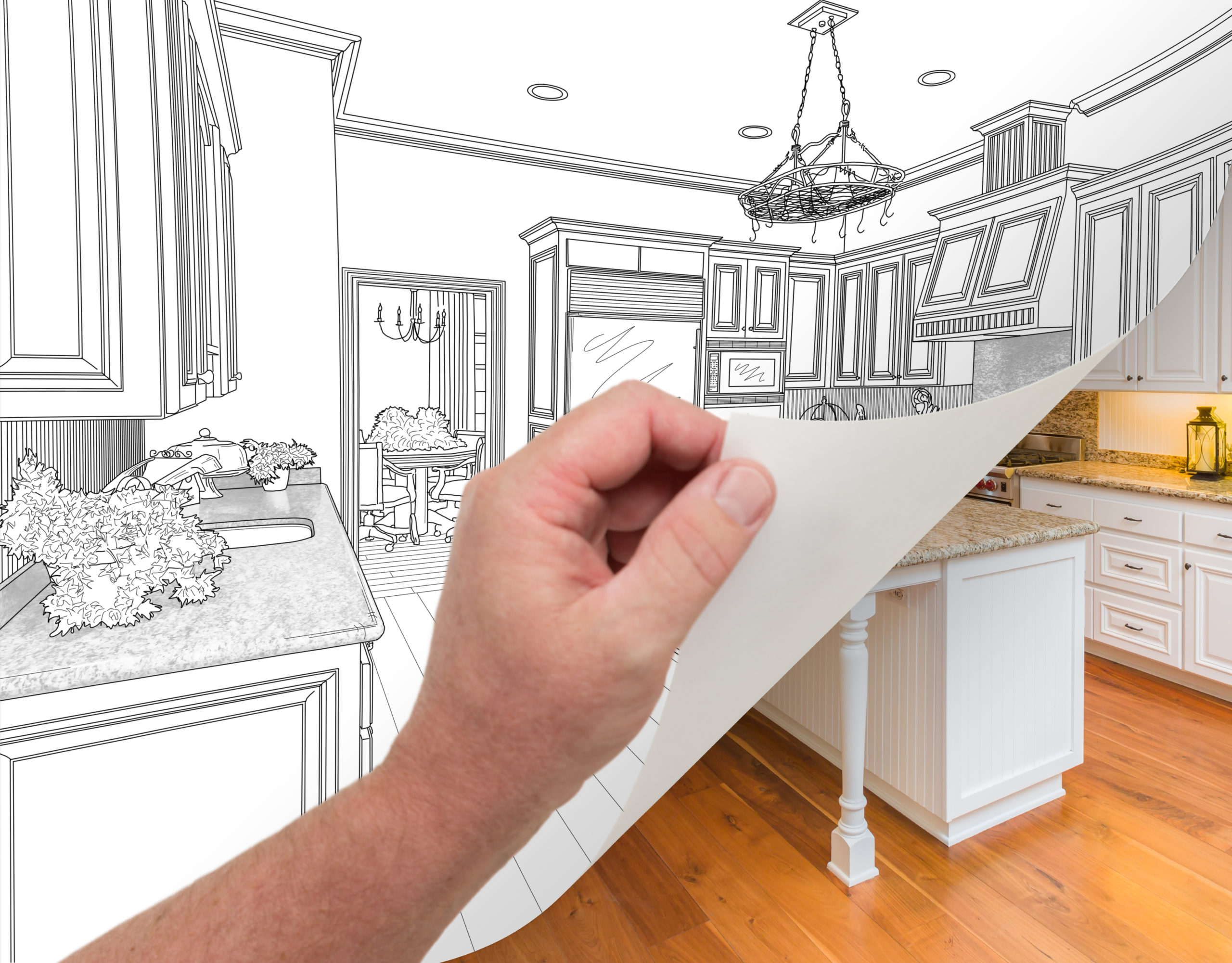

How to Use a Business Loan to Grow Your House Flipping Business

House flipping can be profitable, but it can also be a financial disaster if you don’t invest your resources into houses in areas where people are likely to buy. You also need to put enough time and effort into fixing up the house so that people will be willing to pay more for it than you did. A house flipping loan can help, and you are free to use the proceeds how you see fit. Green Apple Funding outlines several possibilities for your loan funds in this blog post.

Make an Initial Purchase

You need to buy or finance a house before you can fix it up and sell it. Lenders are accustomed to people buying houses just to sell them, so you need not worry that it will somehow ruin your chances of loan approval. Be sure to figure out how much you can afford to pay for the initial investment, so you don’t get in over your head right off the bat.

Hire Experienced Contractors

Some tasks, such as installing electricity, plumbing, and a heating and air conditioning unit, will be beyond your ability unless you have specialized training in one of those areas. When hiring contractors, remember that the one who charges the least isn’t always the right person for the job. Always ask for references and run a background check before bringing anyone new onto your property.

Buy Supplies with Your House Flipping Loan

You can expect to purchase a lot of supplies when you obtain your first property, but the good news is that you won’t have to make the same investment each time. Some of the supplies you will need include tools like a hammer and saw, lumber, and sheetrock. You can write off any expenses incurred for your house flipping business on your federal and state tax returns.

Still Looking for a Lender?

Green Apple Funding offers house flipping loans and other forms of flexible financing. Please contact us today to learn more.